The following sections explore key aspects and facts about Jordan, offering insights into its population, geography, and the dynamics of its economy, trade, and business sectors.

1. Introduction

Jordan is an Arab Muslim country located in West Asia, in the northern part of the Arabian Peninsula. It shares borders with Syria to the north, Iraq to the east, Saudi Arabia to the south and southeast, and Palestine (the West Bank) to the west.

Jordan is a young state with ancient roots, as it witnessed many civilisations over the past five thousand years—such as the Roman, Greek, and Nabataean civilisations. As for Jordan’s capital city, Amman, it is one of the region’s most important commercial and transportation centres, in addition to being a major cultural hub across Arab countries.

2. Jordan’s Geography

Jordan shares a 744 km border with Saudi Arabia, 375 km with Syria, and 181 km with Iraq. Its highest point is the summit of Mount Umm Al-Dami, which rises to 1,854 metres above sea level.

That being said, Jordan has three major geographical regions and zones:

- The Desert Region: The Jordan desert covers four-fifths of the country's total area from east to west, and it is an extension of the Arabian Desert and spans Jordan’s eastern and southern territories.

- Uplands East of the Jordan River: This elevated region forms an escarpment that overlooks the Rift Valley. It averages between 2,000 and 3,000 feet (600–900 metres) in height and reaches its highest elevation at Mount Umm Al-Dami in the south, standing at approximately 1,854 metres.

- The Jordan Valley: Located at the northwestern edge of the East African Rift System, the Jordan Valley descends to around 408 metres below sea level at the Dead Sea—making it the lowest natural point on Earth's surface.

3. Regions

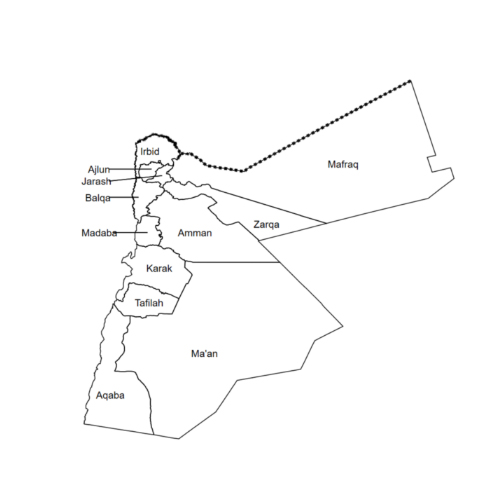

From an administrative perspective, Jordan is divided into 12 governorates that are grouped into three regions, as outlined in the table below:

| Governorate | Area (km²) | Population |

| North Region | ||

| Mafraq | 26,551 | 675,200 |

| Irbid | 1,572 | 2,173,200 |

| Ajloun | 420 | 216,200 |

| Jerash | 410 | 291,000 |

| Total | 28,953 | 3,355,600 |

| Central Region | ||

| Amman | 7,579 | 4,920,100 |

| Zarqa | 4,761 | 1,675,700 |

| Balqa | 1,120 | 603,700 |

| Madaba | 940 | 232,300 |

| Total | 14,400 | 7,431,800 |

| South Region | ||

| Ma'an | 32,832 | 194,500 |

| Aqaba | 6,905 | 245,200 |

| Karak | 3,495 | 388,700 |

| Tafilah | 2,209 | 118,200 |

| Total | 45,441 | 946,600 |

| Jordan Total | 88,794 | 11,734,000 |

Map Source.

4. Climate in Jordan

The climate in Jordan is characterised by being hot and dry during the summer, while it is mild and humid in the winter. Temperatures typically range between 12 and 25 degrees Celsius but can reach up to 40 degrees Celsius in desert areas.

5. Jordan Population

According to up-to-date data, Jordan's population has reached over 11 million people in 2025. Arabs make up the vast majority of the population, primarily Jordanians and Palestinians. Minority groups include a significant number of Syrian refugees who arrived during the Syrian Civil War, as well as Iraqis who fled to Jordan following the Persian-Gulf War and the Iraq War.

6. Jordan Language

The official language in Jordan is Arabic, which is spoken by all Jordanians. People speak various dialects, but they are all mutually understandable and resemble the Levantine Arabic, which is common in Palestine, Lebanon, and Syria.

7. Jordan Religion

The official religion of Jordan is Islam, with Sunni Muslims comprising approximately 92% of the population. Christians represent around 6%, the majority of whom belong to the Orthodox Church.

8. Jordan Demographics

Internal migration from rural to urban centres has increased over the last 25 years. The population structure is predominantly young, with individuals under age 16 constituting more than one-third of the population.

9. Jordan Economy Overview

Jordan is classified as an upper-middle-income country, recognised as one of the most open and diversified economies among Arab countries. Its economic structure is defined by strong contributions from sectors such as trade, finance, industrial production, and services. Today, the services sector leads the economy, accounting for nearly two-thirds of GDP, followed by industry at just under one-third, with agriculture making up a smaller share.

Economic diversification has been a central theme of Jordan’s development. Since 1999, the government has launched a series of economic reforms aimed at strengthening growth and stability—reforms that laid the foundation for the country’s resilience and competitiveness.

Building on this momentum, one of the most significant initiatives to date is the Economic Modernisation Vision—a comprehensive national strategic framework launched in 2022 under royal patronage. It aims to transform Jordan’s economy, elevate living standards, and enhance the country’s global competitiveness over ten years. The vision is built on eight strategic growth drivers and includes 366 initiatives across 35 sectors. Implementation is structured in three phases: 2022–2025 (major initiatives), 2026–2029 (expansion and consolidation), and 2030–2033 (future planning to meet the needs of the next decade). For more information, please visit the official Jordan Economic Modernisation Vision website.

Jordan’s economic performance reflects steady progress and growing competitiveness across various global indicators, some of which are as follows:

- As of 2024, Jordan’s GDP stood at approximately $53.35 billion (current US$), making it number 92 in the ranking of GDP of the 196 countries published on CountryEconomy. Click here for the latest data and here for the latest rankings.

- Jordan’s GDP per capita reached $4,618.10 (current US dollars) in 2024. Click here to access the most recent data.

- According to the OEC (Observatory of Economic Complexity), Jordan was no. 87 in total exports and no. 75 in total imports as of 2023. Check the OEC for periodically and annually updated figures.

- Based on different Economic Complexity Index (ECI) methodologies, Jordan ranked 63rd in ECI Trade (2023), 72nd in ECI Technology (2021), and 57th in ECI Research (2023). Access the most recent rankings here.

- In the 2025 IMD World Competitiveness Ranking, Jordan earned a score of 47, reflecting progress in key economic and institutional indicators. Explore Jordan’s profile for the most recent rankings and deeper insights.

- IMD’s Business Efficiency metric serves as a broad indicator of Jordan’s economic competitiveness. In 2025, Jordan maintains a score of 55.3, and it ranks 33rd, reflecting its performance in areas such as productivity, labour market effectiveness, and financial management within the private sector. Discover the IMD’s Business Efficiency metric for the latest ranking and score.

- Jordan ranked 73rd among the 133 economies featured in The Global Innovation Index (GII) in 2024. This index ranks world economies based on their innovation capabilities. Check Jordan’s profile for more detailed information and the latest figures.

- Jordan performs better than many countries in the region in areas like product innovation, technology use, entrepreneurship, and economic competitiveness, according to the Global Innovation Index and similar sources.

9.1. Business Sectors in Jordan

Jordan’s business landscape is evolving toward promising new horizons. To boost its business environment and overcome any emerging challenges, Jordan is enhancing education and healthcare services, modernising infrastructure, addressing structural issues, and prioritising export strategies.

Therefore, Jordan has developed progressive policies that have strengthened its economic foundation and attracted investment, and below are some of them:

- Jordan was the first Arab country in the Middle East to adopt competition legislation in 2002, marking a significant step toward regulatory reform. Check this report for more information.

- Jordan has also opened its financial services sector to foreign competition, encouraging greater integration into the global market. This report by the World Trade Organisation provides further insights into this development.

- Investment opportunities in Jordan have been actively promoted since 1985 through the Investment Promotion Law, which laid the foundation for attracting regional and international investors. More details can be found in this report by the General Budget Department (GBD) and on their official website.

- Jordan has established several locations to promote investment, including various industrial estates, development areas, free zones, and the Aqaba Special Economic Zone (ASEZ).

Enabled by the above policies, Jordan’s key economic sectors have become increasingly active in shaping the country’s GDP. Below are some sector-specific insights:

- According to the World Bank, Jordan’s total trade in goods and services amounted to 100% of GDP in 2024, reflecting a highly open economy. This trade-to-GDP metric is updated yearly, reflecting up-to-date figures when available.

- Regarding exports of goods and services, the share stood at 42.6% of Jordan’s GDP in 2024. For updated figures, please click here.

- Net foreign direct investment (FDI) inflows are a strong indicator of financial sector activity. According to the World Bank, FDI inflows into Jordan accounted for 1.6% of GDP in 2023. Click here to check the automatically updated figures and data.

- According to the World Bank’s World Development Indicators, the industrial sector—including mining, manufacturing, utilities, and construction—accounted for approximately 24.8% of Jordan’s GDP in 2023, while the services sector, which encompasses transport, storage, communications, and public utilities, represented around 60.8%. Discover the latest data here.

- The Jordan ICT’s sector holds the leading position in the MENA region with a modern, world-class ICT infrastructure. Check this sector profile for more information.

- Check the Jordan Department of Statistics – Data Portal here to view sectoral contributions to the GDP by annual or quarterly frequency.

Building on the official policies and the overview of sectoral contributions above, the following section explores Jordan’s primary economic and business sectors, grouped under the Industrial Sector and the Services Sector. Below are the key industries that make up the Industrial Sector, along with further insights into each of them:

- Wood and Furniture: Jordan’s wood and furniture sector serves over half of local demand and exports to around 70 countries, supported by a network of over 2,000 establishments and a workforce exceeding 10,000, most of whom are Jordanian. Click here for more details.

- Engineering, Electrical and Information Technology: Jordan Vision 2025 promotes a knowledge-based economy by supporting the growth of engineering, electrical, and IT industries—three interconnected sectors driving innovation in smart infrastructure, industrial automation, and high-tech exports.

- Food, Catering, Agriculture, and Livestock: Given Jordan's water scarcity, the government adopts innovative techniques like drip irrigation and hydroponics to maximise the productivity of its land resources. At the same time, the livestock sector—especially sheep farming—plays a vital role in supporting both food security and exports.

- Packaging, Paper, Cardboard, Printing and Office Supplies: This sector has experienced significant expansion over two decades, with operational facilities increasing to 812 establishments nationwide and exports reaching 44 markets. Discover more insights here.

- Plastic and Rubber: It is one of the most stable and diverse fields in Jordan’s manufacturing, with its products reaching 70 export markets worldwide, featuring over 95 products.

- Mining: Jordan’s mining sector is anchored in phosphate and potash extraction—mined from the Dead Sea region—and plays a foundational role in fertiliser and mineral derivatives production.

- Therapeutic and medical supplies: Jordan is one of the leading exporters in this type of supplies, with major accomplishments in production, exports, and technological development. Key markets include Saudi Arabia, Iraq, Algeria, and the United States.

- Leather and Garment: This sector holds historical significance in Jordan, being the oldest in the region. It dates back to the establishment of the country’s first clothing factory in 1949 and its first tannery in 1921.

- Chemical and Cosmetic: A leading field in Jordan’s economy, especially considering its support for the flow of foreign currency. It is supported by the Economic Modernisation Vision (EMV), which aims to further enhance the sector's contribution to the GDP and boost employment.

- Construction: Jordan has a rich variety of construction materials, particularly natural stone, which has long been a defining feature of the country's architectural identity.

- Agriculture: Key Jordanian agricultural exports include tomatoes, bell peppers, lettuce, peaches, watermelon, dates, and figs, among many others. The main export markets for these products are Saudi Arabia, Kuwait, the UAE, and Bahrain.

Jordan has also established its Service Sector, with the following areas being the most prominent:

- Construction Services: Entities like the Jordan Engineers Association (JEA) and Jordan Construction Contractors Association (JCCA) support those services in terms of regulating licensing, enforcing quality standards, and maintaining ongoing professional development to uphold construction excellence in Jordan.

- Transportation Services: The Jordanian Ministry of Transport is currently implementing a five-year public transportation strategy for 2022 to 2027 to elevate transportation and reduce the use of cars, the emissions resulting from transportation, and energy usage. Click here for more information.

- Tourism Services: Those services in Jordan are receiving a boost with the Economic Modernisation Vision, as it has a pillar dedicated to tourism called “Destination Jordan.” It aims to place the country as one of the top tourism and film production destinations.

- Health and Social Services: Jordan is known for its high-quality healthcare system and its key role in providing health and social services to vulnerable populations, especially refugees. These efforts are supported by institutions like the World Bank and UNHCR.

- Financial Services: The Central Bank of Jordan (CBJ) has launched a comprehensive Fintech Vision aligned with the Economic Modernisation Vision, aiming to improve financial services, financial inclusion, and customer experiences through digital innovation.

- Environmental Services: The country is enhancing its environmental services by aligning with its national goal to reduce greenhouse gas emissions by 31% by 2030. Through partnerships with entities like the Global Green Growth Institute, efforts focus on green finance, sustainable infrastructure, and climate policy implementation. Read here for further insights.

- Energy Services: Jordan is a regional leader in renewable energy, with solar and wind supplying nearly a third of its electricity. The country aims for 50% renewables by 2030, backed by smart grid upgrades and a green hydrogen strategy. Considering such strategies and plans, green energy services are projected to grow. Here is more related information.

- Education Services: Education is supported by various national initiatives, such as MASAR, the Modernizing Education, Skills, and Administrative Reforms, which aims to enhance access to essential learning and to labour market-relevant technical and vocational training.

- Logistics Services: Developments made to the logistics sector provide a solid foundation to logistics services. Some of these developments are the expansion at Queen Alia International Airport and the Port of Aqaba, in addition to the development of free zones and the planning of a national railway network.

- Communication Services: Jordan’s telecommunications sector has evolved from a state-controlled system to a liberalised, competitive market. Today, it offers a wide range of services, including mobile, fixed-line, and broadband, supported by national initiatives like Digital Jordan 2025 that plans to upgrade networks and expand coverage across the country. Find further information here.

- Business and Professional Services: This sector is experiencing rapid growth, especially in Information Technology (IT) and Business Process Outsourcing (BPO). Jordana also hosts a supportive startup ecosystem and business areas like Abdali and King Hussein Business Park.

9.2. Agriculture

Agriculture plays a crucial role in supporting food security, preserving rural livelihoods, and contributing to economic diversification. In recent years, Jordan has increasingly positioned agriculture as a strategic sector—one that meets local needs and strengthens the country’s presence in regional and international markets.

Therefore, Jordan’s agricultural sector has emerged as a significant contributor to the national economy and a growing key player in international trade. In 2023, it accounted for 13.6% of total export revenue, with export values exceeding JD 1.1 billion, according to the Department of Statistics (DoS).

The upward momentum in agricultural exports continued in 2024, with total export value reaching JD 1.276 billion by the end of October. This growth reflects strong performance across key sub-sectors: livestock, fruits, and vegetables. Click here for further insights.

The government has supported this growth through sustainable agriculture initiatives and export facilitation measures like freight subsidies and international market access agreements. One of the most recently implemented initiatives was the National Plan for Sustainable Agriculture 2022–2025 in coordination with the Ministry of Agriculture and Royal Jordanian Airlines.

9.3. Manufacturing

The manufacturing sector is one of the main pillars in Jordan’s economy, as it plays a vital role in employment and export performance. It encompasses various subsectors, including mining, garments, pharmaceuticals, chemical products, and food processing. That being said, Jordan’s strategic location provides investors and exporters with access to key international markets through various trade agreements and free zones.

The majority of Jordan’s manufacturing activities are concentrated in and around Amman, as this area hosts a wide array of industrial zones and clusters, supporting sectors such as pharmaceuticals, plastics, chemicals, and engineering products. Meanwhile, extractive industries, particularly phosphate and potash mining, have seen increased investment and are expanding their share of Jordan’s total exports, benefiting from global demand for fertilisers and raw materials. Read here for further insights.

Beyond heavy industry, food production continues to grow, supported by Jordan’s role as a regional supplier of processed goods like canned vegetables, dairy, and confectionery. This document provides more details about the export potential of Jordanian processed foods. Moreover, clothing and textile manufacturing remains a key employer and contributor to trade. Additionally, consumer goods production, including detergents, cosmetics, and household items, is gaining momentum as local firms improve product quality and target nearby Arab and international markets.

This sector is increasingly implementing sustainable practices, as seen in the apparel industry, for instance. Clothing factories are progressively using solar energy and water treatment technologies, in addition to adopting environmental standards and responsible production practices. Taking all these factors into account, Jordanian products gain competitiveness in European and US markets. Click here for further information.

9.4. Services

The services sector is the backbone of Jordan’s economy, comprising a wide range of activities including finance, education, healthcare, tourism, information technology, and logistics. Therefore, Amman, the capital, serves as the primary hub for these activities, hosting regional offices of global banks, tech firms, and multinational corporations, while also being home to key tourism services and advanced medical facilities.

Within this sector, Jordan has gained regional recognition for its strength in information technology and business process outsourcing. The country’s highly skilled, multilingual workforce, combined with competitive operating costs, has made it a preferred centre for software development, call centres, and digital services. Read here for more details.

To support such diverse and growing sectors, the Department of Statistics (DoS) in Jordan plays a crucial role in tracking the performance of the services sector by conducting regular surveys and data collection efforts. These surveys cover a broad range of service activities—including education, health, finance, and professional services—to ensure accurate measurement of their contribution to the GDP. Discover their official website for more information.

9.5. Jordan Tourism

Within the services sector, tourism plays a vital role in Jordan’s economy as one of its key service sectors, with competitive strengths in cultural heritage, health, education, and religious tourism. From the mid-1990s, Jordan’s international tourist arrivals rose notably, reaching a high of approximately 8.1 million in 2010—before experiencing a subsequent decline in the 2010s and a sharp drop to around 1.24 million in 2020 amid the COVID-19 pandemic. However, the sector bounced back strongly. By 2023, arrivals had reached approximately 6.35 million tourists, with continued growth into 2024 and 2025.At the same time, Jordan stands out for its excellence in medical tourism—ranked number one in the MENA region by the World Bank—attracting patients from other countries thanks to its high standards of care and medical expertise.

Jordan’s tourism is a leading and significantly diverse export sector within its services-oriented economy. Following a steady upward trend since 2005, international tourism receipts peaked in 2019, accounting for 42% of total exports. In 2020, however, tourism revenue dropped sharply to 17% of total exports due to the global impact of COVID-19—compared to 7% in Turkey and 12% in both Morocco and Egypt. These figures are according to the World Bank's WDI portal, which provides up-to-date World Development indicators, including those related to tourism and other sectors. These numbers also include income from tourism by Jordanians residing abroad.

That said, the sector is backed by a strong policy and institutional framework—anchored in the National Tourism Strategy 2021–2025 and the Economic Modernisation Vision 2022—that creates an enabling business environment for tourism-related exports.

As tourism in Jordan expands into niches like adventure tourism, film tourism, and MICE (Meetings, Incentives, Conferences, and Exhibitions), it supports a wide range of service providers and product exporters. This strategic development strengthens Jordan’s regional competitiveness and contributes to building a sustainable and resilient tourism economy.

9.6. Finance

Jordan’s financial system is jointly shaped by the Ministry of Finance and the Central Bank of Jordan. The Ministry of Finance oversees fiscal policy, including public spending, revenues, and debt management. Meanwhile, the Central Bank of Jordan manages monetary policy, issues the Jordanian Dinar (JOD)—which is pegged to the U.S. dollar—and regulates the banking sector, which includes over 20 local and international banks operating in the Kingdom.

9.7. Resources and Power

Jordan has significant amounts of phosphates and potash, positioning the country as a leading global producer and exporter of these minerals. In addition to its mineral wealth, the country relies heavily on thermal power stations—most of which are oil-fired—to meet its electricity needs. These stations are connected through an integrated transmission system that links the major power plants across the country.

9.8. Jordan Trade

Driven by its open economic approach, Jordan has actively pursued a trade liberalisation strategy that resulted in an open economy with an extensive network of bilateral, regional, and multilateral trade agreements, including partnerships with North America (the United States and Canada) and the European Union.

As a result of these agreements, Jordan’s trade structure has become increasingly diversified. Its primary exports include clothing, chemicals, and potash, while its main imports consist of machinery and equipment, crude petroleum, and food products. Key export destinations include the United States, Iraq, and Saudi Arabia, whereas major import sources are Saudi Arabia, the United States, China, and the EU.

In addition, Jordan joined the World Trade Organisation (WTO) in 2000, further integrating into the global economy. Trade-to-GDP ratios were high in the late 1990s, but they fluctuated in the years following accession due to global and domestic economic changes. According to the World Bank data, the ratio fell to 66% in 2020 due to the pandemic but rebounded to around 100% by 2023, showing the resilience of Jordan’s trade sector.

Click here for more details.

To enhance its global trade engagement, Jordan has signed numerous Free Trade Agreements (FTAs) aimed at expanding market access, reducing tariffs, and encouraging foreign investment. These agreements have played a key role in deepening trade relations and boosting export potential across various sectors. Examples include the Jordan–US Free Trade Agreement, the Jordan–EU Association Agreement, and the UAE–Jordan Comprehensive Economic Partnership Agreement (CEPA), among others. For a detailed overview of Jordan’s free trade agreements and partner countries, explore the Matrix and Insights pages.

Other than the agreements, Jordan’s trade performance and diversification have been supported by a range of modern trade facilitation measures. The country has modernised customs procedures, implemented a risk-based inspection system, and introduced several other reforms to improve efficiency. Click here to find out more. For practical support, the Jordan Export Portal offers solutions and services, market intelligence, and information about export-related initiatives.

Given its potential, the export sector remains a national priority due to its significant employment-generating capacity. Therefore, Jordan is investing in modernisation, enhancing competitiveness, and expanding its export base. According to the International Trade Centre (ITC, 2018), the country could generate over 85,000 new jobs—25% of which could go to women—by unlocking its export potential within the region. Find out more details here.

To support these efforts, Jordan’s National Export Strategy (2023–2025) was launched under the framework of the Economic Modernisation Vision and officially approved by the Council of Ministers in 2023. The strategy aims to increase exports to diverse markets and maximise the benefits of Jordan’s Free Trade Agreements. Click through these sources for deeper insights: Jordan Times and Jordan Exports Newsletter for April 2023.

For the latest trends and detailed breakdowns of Jordan’s export performance, check the following points and resources that offer official data, sector-specific insights, and historical context:

- According to the latest available figures, exports of goods and services accounted for approximately 42.6% of Jordan’s GDP in 2024. This marks a continuation of the country’s strong external trade engagement, following 43.5% in 2023. Click here for the latest data and more information.

- For more historical information, discover this page, as it provides a comprehensive overview of the country’s export data, categorised by year, product, and destination. It includes detailed statistics on export values, annual growth rates, and percentage shares of key export commodities based on the Harmonised System (HS) codes.

- Additionally, details about Jordan exports by category can be found on Jordan’s country profile on the Trading Economics website. To view the latest data on Jordan's export destinations for the most recent full year, click here.

Discover more about trade with Jordan here.

9.9. Healthcare

Jordan’s healthcare is widely recognised for its high standards and advanced capabilities, particularly in specialised care such as cancer treatment and organ transplantation, which is supported by internationally accredited institutions and experienced medical professionals.

The health system is structured across public, private, and non-profit sectors, and it is led by the Ministry of Health, Royal Medical Services, and university hospitals. It delivers a wide range of medical services and supports efforts toward achieving facilitated and easy access to healthcare.

Jordan has made substantial investments in modernising its healthcare system through the adoption of digital health technologies and telemedicine, particularly aimed at improving access in underserved regions. A nationwide programme known as Hakeem, implemented across public hospitals, offers electronic medical records, prescription tracking, and medicine delivery, significantly reducing the need for in-person visits and streamlining care delivery.

In addition, the government has approved a national telemedicine system, fostering remote consultation services to connect patients in rural areas with urban specialists and lowering medical costs. Such digital initiatives are advancing equity in care and supporting Jordan’s broader vision for a fully modernised, accessible healthcare system.

9.10. Information and Communication Technology (ICT)

Jordan has established itself as one of the Middle East's leading centres for ICT innovation and entrepreneurship. Thanks to a competitive telecom industry and a thriving digital economy, the country is witnessing an increase in the number of start-ups, tech companies, and digital media endeavours. Widespread LTE coverage and a growing mobile market have been key factors in promoting digital inclusion and economic growth since the liberalisation of fixed-line services in 2005.

In 2019, the Ministry of Digital Economy and Entrepreneurship (MoDEE) succeeded the former Ministry of Information and Communication Technology (MoICT), marking a strategic shift toward a broader mandate. This transition reflects Jordan’s commitment to fostering not only infrastructure and software development but also digital services, internet platforms, and innovation across sectors. MoDEE now leads national efforts to promote e-government, support digital start-ups, and integrate ICT solutions into public and private services—solidifying ICT’s role as a catalyst for sustainable development and regional competitiveness. Read here for further insights.

One notable platform that contributes to such efforts and aligns with the national initiatives is the Jordan Export Portal. It offers exporters easy access to key trade-related resources, supporting market expansion and global outreach.